President Joe Biden signed the American Rescue Plan Act, a $1.9 trillion relief bill, which includes direct payments of $1,400 per person and an expanded child tax credit. Here’s everything you need to know about the bill.

Here is a brief overview of the American Rescue Plan Act, a $1.9 trillion relief bill, which was signed into law on 03/11/2021. We will update this article as guidance is released and rules are further clarified.

We did not include all aspects of the bill. If you have any comments or would like to see details about any other points, please reach out.

Stimulus Checks – Round 3

Direct payments of $1,400 per person.

Qualified dependents, even those over 17, will also get the full $1,400. (Dependents aged 17+ were excluded from EIP 1 and 2).

Income Requirements

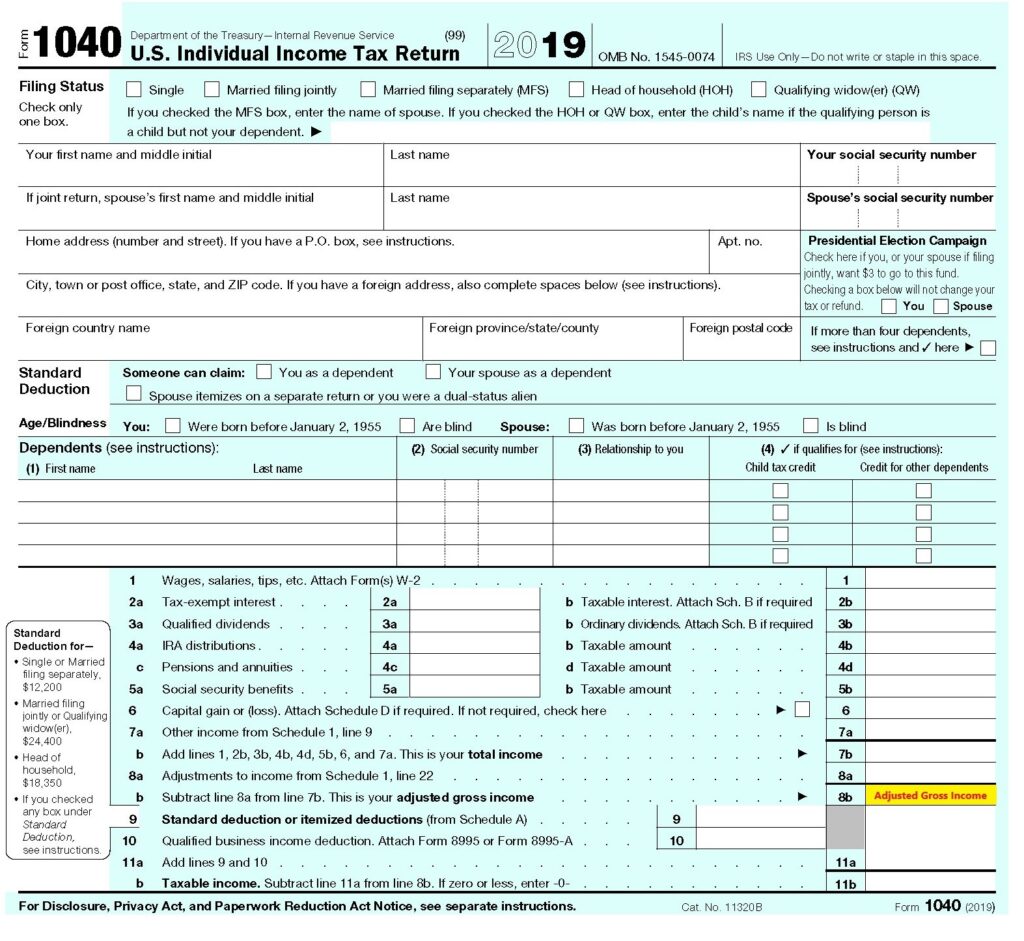

Income is based on Adjusted Gross Income (AGI). For 2019, your AGI is reported on 1040 line 8B, and for 2020, line 11. See sample 1040 below.

The following receive the full amount ($1,400 per filer and $1,400 per dependent)

- Individuals filers who earn up to $75,000

- “Married-filing-jointly” who earn up to $150,000

- “Head-of-Households” who earn up to $112,500

Those earning more than the above amounts will see their $1,400 phased out. If your Adjusted Gross Income AGI is above $80,000 (singles), $120,000 (head-of-household), or $160,000 (joint filers) then you (and your dependents) won’t get any stimulus.

Which Year is Looked At?

- If you already filed your 2020 return, it will be based on your 2020 return.

- If you didn’t file a 2020 return yet, it will be based on your 2019 return.

- If you didn’t file 2019 yet either, it’s unclear if the IRS will use your 2018 return or not.

Getting the Payment

The payments will be automatic, like the first two Stimulus checks. Payments are expected to start being sent out over the next few days.

If the IRS has your bank account details, you should receive the funds straight to your bank account. If not, you should receive a check in the mail.

There will be a second disbursement of Stimulus payments in a few months for those that filed (or the IRS processed) their 2020 return after the first round of stimulus disbursements. If you were not eligible based on 2019 or you are eligible for an increased amount of stimulus based on your 2020 tax return, you should receive the stimulus or the difference between what you received already and for what you are eligible based on your 2020 return.

If you are not eligible based on 2020 AGI but will be eligible based on 2021 AGI (or you are eligible for more based on your 2021 situation), you will most likely be able to claim the credit when you file your 2021 taxes. (Stimulus checks 1 and 2 were 2020 tax credits, so anyone who didn’t get those payments can request them when they file their 2020 tax return)

You should soon be able to use the IRS portal to check on your third round of payments (in addition to the first two).

Stimulus payments are not taxable income.

Unemployment

Tax-Free

- As a general rule, Unemployment payments are taxable.

- $10,200 in Unemployment payments received in 2020 will be tax-free for households with under $150,000 income (AGI) in 2020.

- The $10,200 will not count towards AGI

- If both spouses on a joint return received Unemployment payments, each spouse will receive the deduction.

- If you had taxes withheld from Unemployment payments in 2020, you will get it refunded when you file your 2020 taxes. If you already filed 2020 taxes before this bill was passed, stay tuned for the next step (you may need to file an amended tax return – guidance is surely forthcoming).

- The $10,200 tax-free Unemployment is for federal taxes. Each state will make its own decision. We will post an update on what NY decides to do.

Unemployment Extension

- In short, whoever is currently collecting Unemployment can likely continue claiming Unemployment until after the summer.

- If you are getting PUA (Pandemic Unemployment Assistance), you now have 79 payable weeks (up from 50 – or 57 in states with high unemployment)

- If you are getting “regular” Unemployment (UI) and finished your “base weeks” (in NY for example it’s 26 base weeks), you start collecting PEUC (Pandemic Emergency Unemployment Compensation) weeks. These were now raised to 53 payable weeks (up from 24). So for people who have 26 base weeks (like NY), they now have (53 + 26 =) 79 payable weeks. This is besides for EB weeks that many have received.

- The expiration date for the PEUC and PUA programs has been extended to September 6, 2021

Extra $300 FPUC

The $300 weekly “bonus” of FPUC (Federal Pandemic Unemployment Compensation) will continue until September 6, 2021

Child Tax Credit

ChildTax Credit is a credit per child for those with children.

Some of the changes for 2021

The Child Tax Credit for 2021 increased to $3,000 a year for each child ages 6 to 17 (including 17-year-olds), and $3,600 for each child under age 6.

The credit is fully refundable. Everyone who qualifies will get the full amount. (Usually, only $1,400 of the $2,000 is refundable, the rest is only a credit if taxes are owed).

Starting from July 2021, families will be able to request monthly payments in advance of the refund. $300/month per child under 6 and $250/month per child age 6-17. Over the six months July-December 2021, families will be able to collect $1,800 per child under 6 and $1,500 per child age 6-17, so 50% will be an “advance” and the other 50% will be paid after filing 2021 taxes.

Income Requirements

Couples who make up to $150,000 and “head-of-households” with up to $112,500 will receive the full amount. Those who have a higher AGI will be phased out, though will still be eligible for the standard child tax credit of $2,000 per child. For each $1,000 earned above the limit, the refund will be reduced by $50 (5%). There is no minimum earned income amount in order to claim the credit in 2021.

2020 income is used to calculate the credit. If 2020 is not yet filed, then 2019 is used.

Dependent Care Credit

Dependent Care Credit is available for families with child care and senior care expenses. You (and spouse, if married) must have “earned income,”. You must have paid for care so that you could work or look for work. Being a full-time student or a parent unable to care for themself counts as “working” for the purposes of the credit, even if you don’t receive any income for it.

Acceptable Expenses

Childcare expenses for children below kindergarten age are acceptable for the entire day. Expenses to attend kindergarten or a higher grade in school are not acceptable expenses. However, expenses for before- or after-school care of a child in kindergarten or a higher grade is acceptable. The cost of sending your child to an overnight camp isn’t considered a work-related expense. The cost of sending your child to a day camp may be a work-related expense, even if the camp specializes in a particular activity, such as computers or soccer.

Some of the changes for 2021

- Credit is fully refundable (not just a credit off taxes that are owed)

- The credit will cover up to 50% of expenses (instead of up to 35%)

- The amount of expenses that can be applied to this tax credit is:

- $8,000 if you have one child (instead of $3,000), meaning your maximum refundable credit would be $4,000

- $16,000 if you have two or more children (instead of $6,000), meaning your maximum refundable credit would be $8,000

- Couples earning up to $125,000 (instead of $15,000) are eligible for the full 50% credit. For each $2,000 in income over $125k, the credit is reduced by 1% (49% instead of 50% etc). Once your available credit goes down to 20%, it stays at 20% up to an annual income of $400,000, at which point the couple is no longer eligible.

EITC – Earned Income Tax Credit

Earned Income Credit (EIC) is a tax credit/refund of up to $6,660 for people who have earned income up to $56,844. The Earned Income Credit is a percentage of your earned income and depends on your filing status and other details.

Some of the changes for 2021

- Up to $10,000 in investment income is allowed.

- If your earned income was higher in 2019 than in 2021, you can use your 2019 earned income amount to figure your EIC for 2021.

- Those without children can get up to $1,502 (instead of $543).

More…

PPP

Additional 7.25 billion in funding for PPP. Check our PPP Resource Center for everything you need to know about PPP.

EIDL

- Additional $15 billion in funding for EIDL.

- New: $5k Targeted Grant for businesses with 50% loss and less than 10 employees.

FFCRA Expansion

FFCRA (Families First Coronavirus Response Act) is Paid-Covid-Leave. If you need to take off work due to an eligible Covid-related reason, you get paid time off. W2 employees and self-employed / 1099 workers are all eligible.

FFCRA has been extended through September 30, 2021. Plus an additional 10 days of paid leave. It also extends the program to cover leave needed to get and recover from vaccination.

Expanded ERC

Employee Retention Credit extended to December 31, 2021. Employers can get up to $28,000 per employee in 2021.

Includes option for new businesses (started after 02/15/20) to get ERC as well, capped at $50,000 per quarter.

Restaurant Fund

$25 billion fund to help restaurants which were financially affected by the pandemic. Stay tuned.

Rental and Mortgage Assistance

$21 billion additional funding for the Emergency Rental Assistance program

SNAP Increase

Extends the 15% increase in Supplemental Nutrition Assistance Program (SNAP) benefits through Sept. 30, 2021

P-EBT

Funds for families to cover school lunches during school closures to continue through the summer 2021.

WIC Increase

More funds allocated for WIC (monthly food budget for expectant women and children under 5)

Student Loan Forgiveness

Student loan forgiveness (there was talk of $10k forgiveness) is not in the bill, but the bill says that any forgiveness between 12/31/2020 and 01/01/2026 will be tax-free (usually loan forgiveness is taxable).

SVOG

Additional $1.25 billion in funds for the Shuttered Venues Operators Grant – not yet launched. The grant will help eligible businesses that were affected by the pandemic.

1099 Requirements – Change from 2022

Beginning in 2022, third-party payment processors (like PayPal) will have to send a 1099 to people who received over $600 for goods or services during the year. Previously, they only had to report this income if it was BOTH: (a) $20,000 or more during the calendar year, and (b) 200 transactions or more. It’s unclear exactly how this will be implemented.

Health Insurance Premiums

- COBRA– for employees who lost their jobs and elected to retain health insurance converge through COBRA, premium payments will be 100% subsidized April 1, 2021 through September 30, 2021

- Affordable Care Act (health insurance exchange plans)

- Currently, there are credit subsidy limits for households earning between 100% and 400% of the Federal Poverty Levels (multiply by 4 for 400%). The cap would be changed as follows for 2021 and 2022:

- Up to 150% FPL- 0% premiums

- 150% to 200% FPL- premiums from 0% up to 2% of AGI

- 200% to 250% FPL- premiums from 2% up to 4% of AGI

- 250% to 300% FPL- premiums from 4% up to 6% of AGI

- 300% to 400% FPL- premiums from 6% up to 8.5% of AGI

- 400% FPL and higher- premiums up to 8.5% of AGI

Watch a webinar hosted by HomeUnemployed.com and Anash.org, on how to claim PPP loans and grants for self-employed individuals and for small businesses with a payroll.

Visit HomeUnemployed.com for more information.

Discussion

In keeping in line with the Rabbonim's policies for websites, we do not allow comments. However, our Rabbonim have approved of including input on articles of substance (Torah, history, memories etc.)

We appreciate your feedback. If you have any additional information to contribute to this article, it will be added below.